Locus of extremity

Developing economies struggle to cope with a new world

The Turks were not alone. Earlier that day India’s central bank also surprised people by raising rates (albeit by a less extreme 0.25 percentage points) for the third time in five months. South Africa’s monetary authorities followed suit the next afternoon, lifting rates by 0.5 points. The trio deemed their tightening necessary to keep a lid on troublesome inflation and to give a lift to their battered currencies. But it gave their exchange rates only a fleeting lift; late on January 29th they were wobbly again.

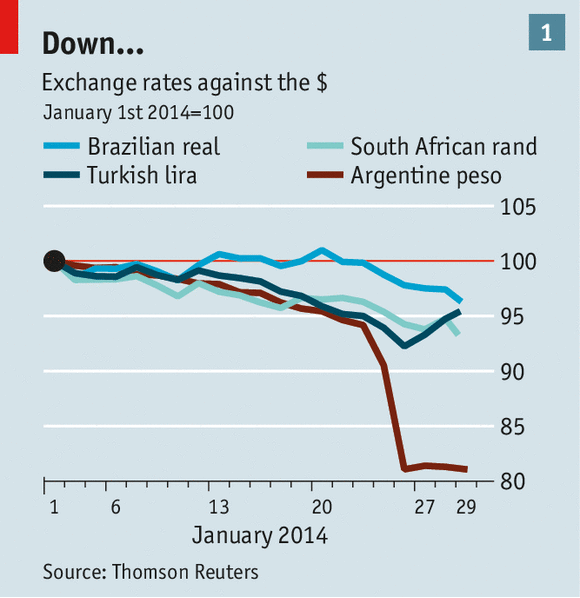

These three economies, alongside Brazil and Indonesia, belong to the “fragile five”. Their currencies suffered dramatic declines last year, after Ben Bernanke, the chairman of America’s Federal Reserve, was tactless enough to say that it would not keep printing money to buy bonds at the same pace for ever. The beleaguered five enjoyed some respite in September, when the Fed decided to maintain its “quantitative easing” for a few months more. But in the past two weeks foreign investors have once again found reasons to sell (see chart 1).

They did not have to look too hard. In recent months Argentina has squandered a big chunk of its foreign-exchange reserves in a doomed defence of the peso, which eventually fell by about 20%, despite the government’s fitful efforts to curtail capital outflows. On January 23rd a widely watched index of manufacturing in China fell by more than expected, raising the prospect of slowing growth amid excessive credit. In Turkey, the sons of three cabinet ministers were arrested in December in a corruption scandal. Meanwhile, in both icy Kiev and balmy Bangkok, protesters are on the streets.

These local difficulties, not all of them little, are unfolding against the backdrop of a gradual rise in global interest rates, as America’s economy strengthens and the Fed moderates its bond purchases. Yields on ten-year Treasuries are still low: about 2.8%. But that is more than one percentage point higher than nine months ago. At Mr Bernanke’s last meeting as chairman, on January 29th, the Fed decided to cut its monthly purchases by another $10 billion, having done the same in December.

The Fed’s bond-buying was not popular in emerging economies. Brazil’s finance minister, Guido Mantega, once accused the rich world of unleashing a currency war: the Fed’s easy money cheapened the dollar, reducing the demand for emerging-market goods. But now that quantitative easing is slowly ceasing, the developing world faces the opposite problem: the Fed’s cutbacks will cheapen American bonds, reducing the demand for emerging-market assets. Alexandre Tombini, governor of Brazil’s central bank, has likened rising rates in the rich world to a “vacuum cleaner” that will suck foreign money out of emerging economies.

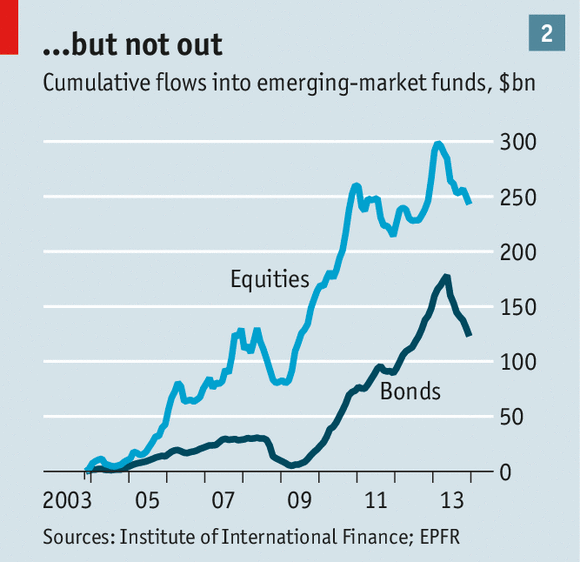

How dependent on that money are emerging economies? The amount of emerging-market bonds and equities that foreigners have accumulated is impressive (see chart). But the income and wealth of the emerging economies have also grown over that period. The 30 most prominent such economies account for almost 40% of global GDP, notes the Institute for International Finance, which represents global banks. Yet their weight in benchmark portfolios of global stocks is only about 13%.

As a group, the emerging economies are actually net exporters of capital to the rest of the world. Even as they have attracted large private capital inflows, their central banks have engineered an even greater capital outflow by accumulating big foreign-exchange reserves. They smoked foreign capital but they did not inhale, as Martin Wolf of the Financial Times once put it.

That is true of the group as a whole. But it is not the case for every member, some of whom breathed deep. Turkey, South Africa, India, Brazil and, latterly, Indonesia have all run troublesome current-account deficits, which have left them vulnerable to capital outflows. Moreover, the current-account is “only the bit of the balance of payments that you can see above the surface,” notes Kit Juckes of Société Générale. Countries can experience large and potentially destabilising capital flows in both directions, even as their current account remains roughly in balance, if inflows differ greatly from outflows in their liquidity, maturity or currency.

India and Indonesia have tried to limit their exposure. India has narrowed its current-account deficit dramatically, helped by a ban on gold imports. Indonesia cut fuel subsidies in June and taxed luxuries that are largely imported. And both countries let their currencies fall—a symptom of overstretch that (by encouraging exports and deterring imports) is also a partial remedy.

As real long-term interest rates rise above zero in America, global investment managers are going through an enormous “one-off adjustment”, Mr Juckes reckons. They are anticipating a “more normal world”, in which pension funds can meet their obligations by holding safe but rewarding assets in countries they know well. It was a world America began to leave behind in late 2007, when the crisis broke and the dramatic rate cuts started. At that time, curiously enough, the central bank of Turkey’s “Locus of Extremity” was on loan to America’s Federal Reserve.

No hay comentarios:

Publicar un comentario